Does Casino Report Winnings Irs

If you have actually got a betting spirit, possibilities are you have actually most likely invested an excellent quantity of time into gambling establishments. If you win huge in Vegas, do not let the excitement of success cloud your head.

If you have actually won cash from betting and you didn’t report your payouts to the Internal Revenue Service, you might be in for a troubling awaken call as casinos report your winnings to the IRS.

Whenever you win cash through betting, you need to report it to the Internal Revenue Service. The Internal Revenue Service needs to know whatever about your financial resources.

Does Casino Report Winnings Irs Filing

Not just do you need to report cash won through a gambling establishment, however likewise raffles, lotto, and even bingo. The factor these profits need to be reported is due to the fact that the IRS regularly receives a gaming report and considers them a kind of earnings.

Whenever you get jackpots from any type of betting you need to report it to the Internal Revenue Service. Earnings that you need to report consist of not just the more conventional gambling establishment design; however likewise lotto, raffles, and yes even bingo.

Due to the fact that the profits are earnings, they naturally need to be reported about taxes on slot machine winnings.

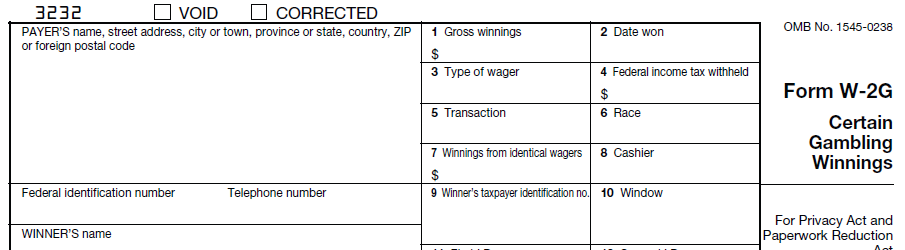

Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips. Much like a bank, a casino (and an online casino) have to keep careful records of big payouts to winners. Usually this is over $2000 (if my memory is correct) and it is something that the casinos take seriously. File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. Gambling proprietors are required by law to report guest winnings that exceed certain predetermined amounts to the IRS. If you don't report your winnings and are audited, you could.

What occurs if you owe the Internal Revenue Service cash due to the fact that you didn’t report the profits, or if you can’t manage to pay them what you owe? Well, as an Internal Revenue Service Hit man I can inform you it’s not going to be quite.

Quickly, you might even be regretting your profits. It will be you versus the Internal Revenue Service and unless you have a great toolbox, they’ll take you for whatever you have actually got!

Do Casinos Report Gambling Winnings To Irs

The Internal Revenue Service has numerous methods of gathering on your tax financial obligation and the most efficient without a doubt is the wage garnishment. This implies the Internal Revenue Service can begin taking cash from your income.

And think what? Neither you, nor your company can do anything about it. The Internal Revenue Service can in fact garnish approximately 75% of your gross pay which can put in a big monetary challenge.

If you’re currently in this regrettable scenario, there are still methods of getting assistance. You can talk with a dependable tax specialist who will offer you the realities on how to solve your tax financial obligation when for all.

Do Vegas Casinos Report Winnings Irs

Your home might be a frightening thing when it concerns the betting market, however the Internal Revenue Service’ Home is even larger. Keep in mind, the next time you’re in Vegas, do not go all in.