Gambling Winnings Federal Tax Rate

Las Vegas is one of the favorite destinations of foreign nationals visiting the USA. If the luck strikes, these foreign nationals can win thousands of dollars at casinos. Nonresident aliens or foreign nationals visit the USA for a short time so most of the time foreign nationals are confident about leaving the USA with the entire amount of gambling winnings. However, the IRS has its own set of rules. Nonresident alien might be subject to 30% tax on gambling winnings so it is essential to understand the IRS regulations in regards to gambling winnings tax.

- You Have to Report All Your Winnings. Whether it's $5 or $5,000, from an office pool or from a.

- In the United States, the tax rate owed on gambling winnings is a flat 25%. If you win big in Las Vegas at poker, the casino must withhold the 25% when collect your cashout, and provides you with IRS form W2-G to report your winnings to the government.

- The IRS requires U.S. Nonresidents to report gambling winnings on Form 1040NR. Such income is generally taxed at a flat rate of 30%. Nonresident aliens generally cannot deduct gambling losses.

This is an email from one of our clients, a foreign national visiting the USA. “I visited the USA in 2012 for 1 month. Specifically, I was in Las Vegas and won $200,000 at the casino. I cannot even describe how happy I was. However, the casino refused to pay me the entire amount of gambling winning. Moreover, I was assessed 30% gambling winnings tax. I will appreciate if you can clarify whether I can claim this money back. I do not think that gambling winnings tax was legitimate in my case.”

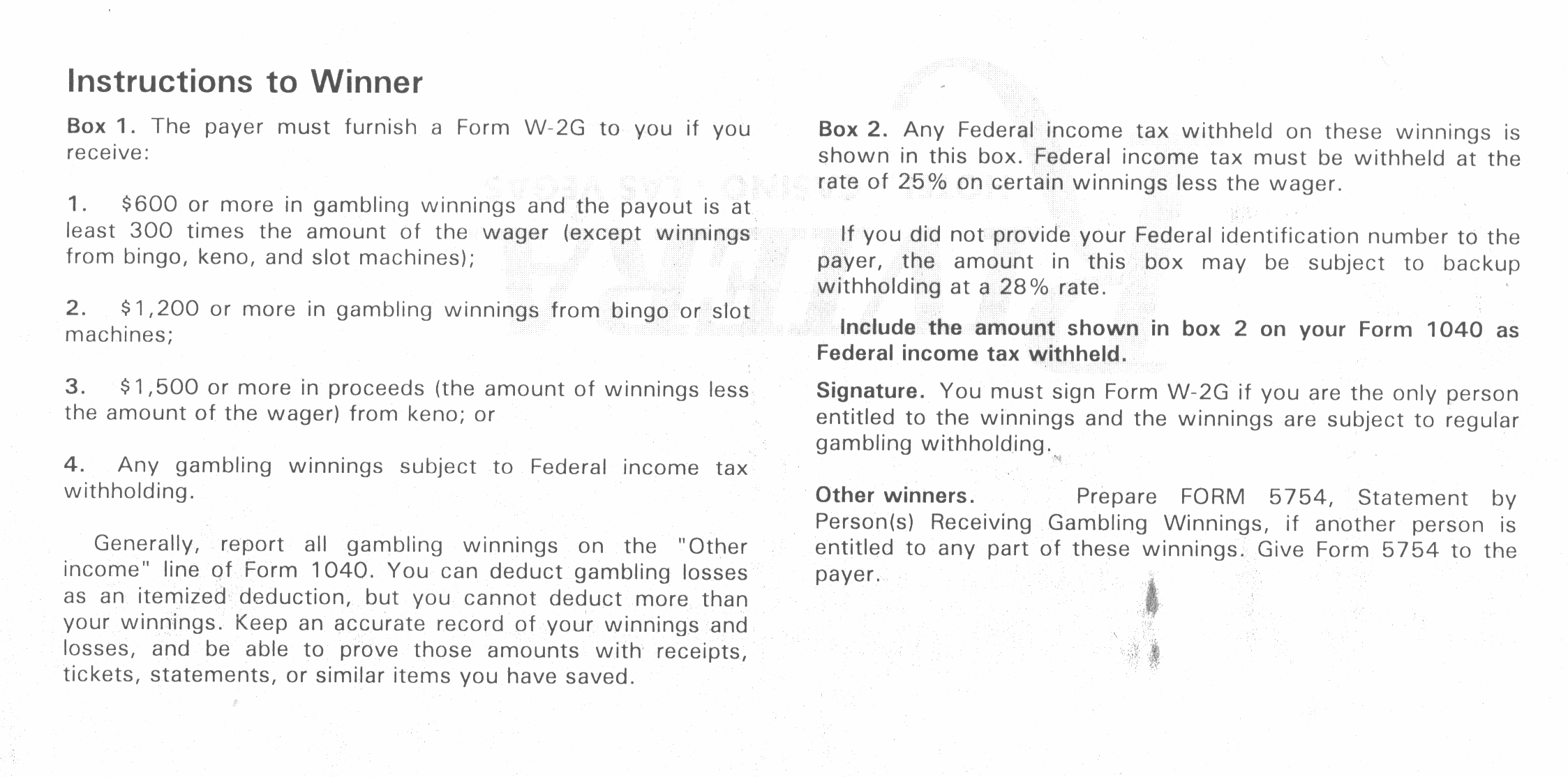

Depending on the size of your win, you may receive a Form W-2G, Certain Gambling Winnings and may have federal income taxes withheld from your prize by the gambling establishment.

The above situation is quite common. Casinos follow the IRS guidelines, however, there are several ways to avoid or to minimize gambling winnings tax on foreign nationals.

IRS Rules and Gambling Winnings Tax on Foreign Nationals

There are several scenarios that might happen.

Foreign Professional Gambler and Gambling Winnings Tax

Las Vegas is famous for hosting professional poker tournaments and other gambling events. Consequently, foreign professional gamblers can win millions of dollars by participating in these events. If foreign nationals or nonresident aliens are engaged in a US trade or business at any time during the year, then they are taxed at regular US rates. Moreover, the US net taxable income is calculated as a difference between US gross income and all applicable deductions. Pending particular circumstances, these foreign professional gamblers will fall into the category “engaged in a US business”. As a result of it, they will not be subject to 30% withholding gambling winnings tax. However, each situation is unique so it is important to analyze specific circumstances.

A taxpayer can be treated as engaged in a US trade or business if their activities in the US are continuous, regular and substantial rather than sporadic or isolated. If it is considered from the context of gambling, this would mean that the non-resident alien (NRA) is inside of the US often enough to be treated as engaged in gambling activity on a regular basis. The NRA would also have to be in the US long enough to be treated as a resident, and subject to the US tax on worldwide income. This fact is determined by using the substantial presence test, where your physical presence inside of the US is evaluated over a 3 year period.

It may also be possible to obtain the professional gambler status if you were in the US only a few times in the year, if the gambling activity involved a significant amount of money. In this circumstance the quality of the type of gambling could outweigh the quantity, allowing you to be considered a professional gambler for US tax purposes.

Your ability to be able to file a tax return as a professional gambler will make a significant difference in the outcome of your tax due. Winnings can be be offset by your losses, and the net gains are taxed at a graduated tax rate. At the graduated rate you may find that the tax rate imposed is substantially less than the 30% rate imposed by the withholding system. Whether or not you are able to receive this financial benefit on your tax return will depend on how the facts submitted to the IRS are interpreted. So a proper guidance from an expat tax CPA is suggested.

Foreign Nationals and 30% Withholding Gambling Winnings Tax

Foreign nationals with US gambling winnings by accident face a different story. These foreign nationals will be subject to 30% income tax rate or lower tax treaty rate because this income is not effectively connected with US trade or business. Some types of gambling winnings are exempt from this tax. Per the IRS regulations the list includes the following games: blackjack, craps, baccarat, roulette or big six wheel.

Foreign Nationals, Tax on Gambling Winnings and US Tax Treaties

The USA signed an income tax treaty with various countries. Several of these income tax treaties have a provision for the gambling income.

There are select countries which have a tax treaty with the United States (US) that will reduce the 30% withholding tax on gambling proceeds. If you are a resident of one these treaty countries, you only need to present a form to the casino that will prevent any withholding tax from being applied.

The nationals of the following countries are exempt from US income tax on gambling winnings.

- Austria

- Belgium, Bulgaria

- Czech Republic

- Denmark

- Finland, France

- Germany

- Hungary

- Iceland, Ireland, Italy

- Japan

- Latvia, Lithuania, Luxembourg

- Netherlands

- Russia

- Slovak Republic, Slovenia, South Africa, Spain, Sweden

- Tunisia, Turkey

- Ukraine, and the United Kingdom

The form that you need to present is W8-BEN. This form will assist you in claiming the treaty benefits along with your Individual Taxpayer Identification Number (ITIN).

If a a tax was withheld on your gambling earnings, you do have the option of filing a US tax return and request the IRS for a refund. In order to do so, you will need to file Form 1040-NR, once the tax year has been completed.

How to claim a tax treaty rate on gambling winnings of foreign nationals?

Foreign nationals must file the IRS Form 1040NR to claim a tax treaty rate and to minimize the amount of gambling winnings tax. Some other countries have a lower tax treaty on gambling winnings too.

Conclusion

Foreign nationals with gambling winnings are suggested to contact an expat tax CPA that specializes in working with nonresidents with US interests. There are several ways to minimize US gambling winnings tax so it is important to review each individual situation with an expert. International tax experts at Artio Partners are pleased to assist foreign nationals with US interests.

Related posts:

Gambling Winnings Federal Tax Rates

Advertiser DisclosureWe think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and Jennifer Samuel, senior product specialist for Credit Karma Tax®.

Gambling may just be a hobby to you, but there’s nothing casual about it when it comes to filing your federal income taxes.

Nearly two-thirds of Americans gamble, according to a 2016 Gallup poll. And while you might think that winning a few bucks from a scratch ticket or a weekend trip to Vegas isn’t a big deal, the government considers every dollar you win from gambling as taxable income.

As a result, it’s important to understand how to report your gambling winnings, what to include and how you can use your losses in your favor. Here are some things you should know about how gambling winnings are taxed.

1. You must report all your winnings

Depending on how much you won during the year, you may receive a Form W-2G listing your gambling winnings. But even if you don’t receive the form, you’re still required to report all your winnings as “other income” on your tax return.

“All cash and non-cash gambling winnings are taxable and should be reported as ‘other income,’ ” says Patrick Leddy, partner at Farmand, Farmand & Farmand LLP. This includes any winnings you received from casinos, lotteries, raffles or horse races. Non-cash winnings, such as prizes like cars or trips, are also considered taxable income and are taxed based on their fair market value.

To make sure you keep track of both your winnings and losses, record the following details every time you gamble:

- The date and type of your gamble or gambling activity

- The name and location of the gambling establishment

- Names of other people who were with you, if applicable

- How much you won or lost

- Related receipts, bank statements and payment slips

2. You can deduct some losses

No one likes to talk about how much money they lost gambling. But when it comes to your tax return, being honest can save you money. That’s because the IRS allows you to deduct gambling losses.

Though you may not be able to deduct all your losses.

“Taxpayers can deduct gambling losses only up to the amount of their gambling winnings,” says Leddy, “and only if they itemize their deductions.”

For example, if your gambling winnings totaled $5,000 in the tax year, but you lost $6,000, you can only deduct $5,000 of those losses. Keep in mind, itemizing your deductions may not afford you the maximum tax benefit. If your total itemized deductions — which can also include charitable donations, home mortgage interest and medical expenses — don’t exceed your standard deduction, itemizing might not be the optimum choice for you.

Can I deduct the cost of a gambling addiction recovery program?

IRS Publication 502 lists alcohol and drug-related addiction-recovery programs as eligible for the medical expense deduction. However, gambling addiction isn’t included. If you need help dealing with a gambling addiction, you can call the Substance Abuse and Mental Health Service Administration’s 24/7, 365-days-a-year hotline at 1-800-662-4357.

3. Even illegal gambling winnings are taxable

According to the American Gaming Association, it’s estimated that Americans spend more than $150 billion per year on illegal U.S. sports betting — and yes, that can include your office March Madness pool.

A May 2018 U.S. Supreme Court ruling opened the door for states to legalize sports betting, but not all have done so. That said, any winnings you receive from betting on sports legally or illegally (or from any illegal activity, for that matter) are still taxable.

Learn more about sports betting and taxesBottom line

So how are gambling winnings taxed? Every dollar you win from gambling, whether legally or not, is considered taxable income. As a result, it’s critical that you keep a record of your winnings so that you can report them accurately. You’ll also want to keep track of your losses so that you can use them to qualify for a tax break.

State Tax On Gambling Winnings

Once you’re ready to file your taxes, Credit Karma Tax® can help show you where to include both your winnings and your losses so that you can maximize your tax refund if you’re owed one.

Jennifer Samuel, senior tax product specialist for Credit Karma Tax®, has more than a decade of experience in the tax preparation industry, including work as a tax analyst and tax preparation professional. She holds a bachelor’s degree in accounting from Saint Leo University. You can find her on LinkedIn.